Understanding mortgage rates can feel like being on a rollercoaster ride. Just when you think you have a grip on where things are headed, the rates twist and turn, making your head spin. But don't worry! With a little knowledge and some smart strategies, you can master these fluctuations and make them work for you.

First off, let’s break down what influences mortgage rates. Think of rates as being affected by a mix of economic conditions, market trends, and even government policies. When the economy is strong and jobs are plentiful, rates tend to rise. Conversely, during economic slowdowns, lenders may lower rates to encourage borrowing. Keep in mind that lenders want your business, so they adjust rates based on how much demand there is for loans.

Now, let’s look at the types of mortgage rates available. There are fixed-rate mortgages, where your interest rate remains the same throughout the loan term, and adjustable-rate mortgages (ARMs), which can fluctuate after an initial fixed period. Fixed-rate loans offer stability—ideal for those who prefer predictability. On the other hand, ARMs may start with lower rates, but they can change after a set period, which may lead to higher monthly payments down the line. Understanding these options can help you decide which path feels right for your financial situation.

Next, it’s important to recognize that timing can play a significant role in determining when to secure your mortgage. Many homebuyers wonder whether they should lock in a rate now or wait for the possibility of lower rates in the future. This decision can feel daunting, but the key is to consider your own financial goals and market conditions. If you find a rate that fits comfortably within your budget, locking it in can provide peace of mind, especially if you plan to stay in your home for a while.

Another way to navigate rate fluctuations is to consider your credit score. Lenders view higher credit scores as a sign of reliability, which can translate into lower mortgage rates for you. If your credit score is less than perfect, take steps to improve it before applying for a mortgage. Pay down debts, make payments on time, and avoid taking on new debt to boost your score. A stronger credit score can save you money in the long run.

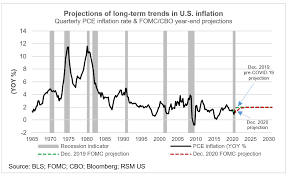

Additionally, it’s wise to stay informed about economic indicators that can affect mortgage rates. Keep an eye on the job market, inflation rates, and the policies of the Federal Reserve. For instance, if employment numbers are strong or inflation rises, this could lead to higher rates. Understanding these indicators will empower you as a consumer, helping you make educated choices about your mortgage.

You may also want to consider the benefits of working with a knowledgeable loan officer. A skilled mortgage professional can help guide you through the complexities of mortgage options and rate changes. They can offer you insights based on current market conditions and help you choose a loan that suits your needs. Their expertise can turn what seems like a rollercoaster ride into a smooth journey.

Now, let’s talk about strategy. If you’re looking to buy a home, create a budget that accounts for potential rate increases. This way, you won’t be caught off guard if rates take a sudden leap. Consider the total cost of homeownership, including property taxes, insurance, and maintenance costs. By preparing for the worst, you’ll be ready to tackle whatever comes your way.

If you’re refinancing an existing mortgage, timing is crucial. While rates may fluctuate, a refinance can often save you money on monthly payments if done at the right moment. Calculate whether the potential savings from a lower rate outweigh the costs associated with refinancing. It could be worth the effort to see if you qualify for a better rate, especially if your credit score has improved since you first took out your mortgage.

As you navigate the world of mortgages, don’t hesitate to ask questions. Whether you’re curious about how rates are set or want to know more about loan options, your loan officer is there to help. Don’t be shy about reaching out! Having a conversation can clarify any uncertainties and empower you to make informed decisions.

Lastly, remember that every consumer’s situation is unique. What works for one person may not work for another. As you absorb information about rate fluctuations, think about your personal financial goals. Are you looking for stability? Or are you open to taking a little risk for potential savings? Reflecting on these questions will allow you to tailor your mortgage journey to fit your needs.

In summary, riding the rate rollercoaster doesn’t have to be a scary experience. With the right knowledge, preparation, and guidance, you can navigate mortgage fluctuations like a pro. Whether you’re purchasing a new home or refinancing an existing mortgage, understanding how rates work and being proactive about your financial decisions will help you stay on track.

If you have questions about your specific mortgage needs or if you would like to explore your options further, we encourage you to reach out. Our team of mortgage professionals is here to assist you every step of the way. Don’t hesitate to contact us to discuss your needs and goals!